Market drag: China slowdown puts renewable energy investment into reverse gear

Renewable energy investment in China fell by 39 per cent through the first half of 2019, but massive solar and offshore wind investments in Dubai and Taiwan signpost the way to future growth

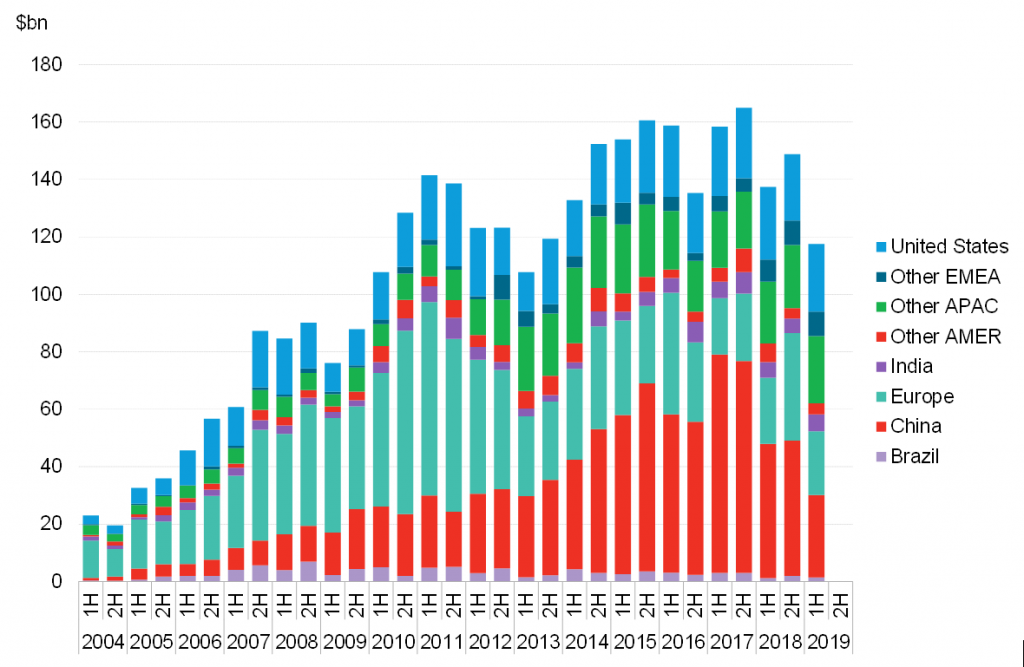

A sizeable slowdown in Chinese renewable energy spending caused global investment in clean energy to fall by 14 per cent through the first half of 2019, according to the latest figures from BloombergNEF (BNEF).

The influential analyst house revealed that investment in the world's largest rebnewables market fell 39 per cent year-on-year to $28.8bn, delivering the lowest figure for any half-year period since 2013.

The drop off in activity resulted in large part from the country's shift from government-set tariffs to auctions for new wind and solar capacity, according to BNEF's analysis.

The drop sent ripples through the global market, with the worldwide investment figures for the first half of the year falling 14 per cent to $117bn.

However, analysts said that the scale of the year-on-year drop in investment levels probably overstates the seriousness of the headwinds faced by the sector.

"The slowdown in investment in China is real, but the figures for first-half 2019 probably overstate its severity," said Justin Wu, head of Asia-Pacific for BNEF. "We expect a nationwide solar auction happening now to lead to a rush of new PV project financings. We could also see several big deals in offshore wind in the second half."

Wu's optimism is supported by a countervailing clean investment highlight from the first half of the year: the financing of a number of landmark multibillion-dollar projects in two emerging markets.

One of the projects - a 950MW, $4.2bn solar thermal and photovoltaic complex in Dubai - was delivered through the biggest ever financing ever seen in the solar sector. Named the Mohammed bin Rashid Al Maktoum IV project, it involves $2.6bn of debt from 10 Chinese, Gulf, and Western banks, plus $1.6bn of equity from Dubai Electricity and Water Authority, Saudi-based developer ACWA Power, and equity partner Silk Road Fund of China.

"Al Maktoum IV is an unusual one in combining three different types of solar - the thermal technologies of parabolic trough and tower, with conventional PV - but it is also a strong signal of the appetite for solar electricity on the part of both Middle Eastern countries and international financiers," said Jenny Chase, head of solar analysis for BNEF.

Similarly, two giant offshore wind arrays in the sea off Taiwan were confirmed during the first half of the year, boasting capacities of 640MW and 900MW at an estimated combined cost of $5.7bn. The projects - which bring together European developers, investors and banks with local clean energy players - reflect the broadening geographical focus of offshore wind activity, BNEF said, as the sector spreads from Europe's North Sea and China's coastline to new markets such as Taiwan, India, and Vietnam.

More broadly, BNEF's figures show mixed fortunes for the world's major markets. Modest falls in investment of six per cent and four per cent in the US and Europe, respectively, were balanced by three per cent growth in Japan, bringing total investment to $8.7bn, 10 per cent growth in India which took investment to $5.9bn, and a 19 per cent surge in investment in Brazil taking fuirst half activity to $1.4 bn.

Within Europe, Spain was the star performer, ith investment soaring 235 per cent to $3.7 bn, while the UK grew 35 per cent to $2.5 bn. Germany was down 42 per cent at $2.1 bn and France plummeted 75 per cent to $567m.

The overall slowdown in investment levels will further fuel concerns that the world is way off track for delivering on the goals of the Paris Agreement. However, analysts maintain that plummeting clean tech costs and renewables increased competitiveness means the fundamentals for the sector remain broadly positive.

Wu's optimism is supported by a countervailing clean investment highlight from the first half of the year: the financing of a number of landmark multibillion-dollar projects in two emerging markets.

One of the projects - a 950MW, $4.2bn solar thermal and photovoltaic complex in Dubai - was delivered through the biggest ever financing ever seen in the solar sector. Named the Mohammed bin Rashid Al Maktoum IV project, it involves $2.6bn of debt from 10 Chinese, Gulf, and Western banks, plus $1.6bn of equity from Dubai Electricity and Water Authority, Saudi-based developer ACWA Power, and equity partner Silk Road Fund of China.

"Al Maktoum IV is an unusual one in combining three different types of solar - the thermal technologies of parabolic trough and tower, with conventional PV - but it is also a strong signal of the appetite for solar electricity on the part of both Middle Eastern countries and international financiers," said Jenny Chase, head of solar analysis for BNEF.

Similarly, two giant offshore wind arrays in the sea off Taiwan were confirmed during the first half of the year, boasting capacities of 640MW and 900MW at an estimated combined cost of $5.7bn. The projects - which bring together European developers, investors and banks with local clean energy players - reflect the broadening geographical focus of offshore wind activity, BNEF said, as the sector spreads from Europe's North Sea and China's coastline to new markets such as Taiwan, India, and Vietnam.

More broadly, BNEF's figures show mixed fortunes for the world's major markets. Modest falls in investment of six per cent and four per cent in the US and Europe, respectively, were balanced by three per cent growth in Japan, bringing total investment to $8.7bn, 10 per cent growth in India which took investment to $5.9bn, and a 19 per cent surge in investment in Brazil taking fuirst half activity to $1.4 bn.

Within Europe, Spain was the star performer, ith investment soaring 235 per cent to $3.7 bn, while the UK grew 35 per cent to $2.5 bn. Germany was down 42 per cent at $2.1 bn and France plummeted 75 per cent to $567m.

The overall slowdown in investment levels will further fuel concerns that the world is way off track for delivering on the goals of the Paris Agreement. However, analysts maintain that plummeting clean tech costs and renewables increased competitiveness means the fundamentals for the sector remain broadly positive.